Microsoft offers Windows 11 for HoloLens 2

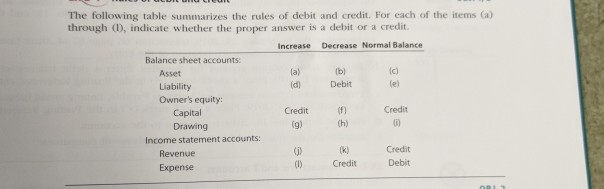

DEBIT CREDIT TABLE UPDATE

Windows 11 update brings Bing Chat into the taskbar Microsoft PowerToys 0.69.0: A breakdown of the new Registry Preview app Image: Screenshot Must-read Windows coverage Solutions are simpler than you might think. It should also be noted that debits are always recorded on the left and credits are always recorded on the right.How to calculate conditional running totals in an Excel revenue sheetĪdding a running total to a simple Microsoft Excel revenue sheet isn't difficult, but adding a conditional running total will require a bit more effort.

To understand it better, one can take note of its effect on specific types of accounts: Debit Debits and Credits Chartĭebits and Credits can be a little complicated to understand in the beginning. The amount received by X Company from Partner B increased the Cash account by $150,000 and also increased the Equity amount of Partner B by $150,000. The receipt of cash from Partner B will be recorded as To increase it, a credit entry has to be passed.įor example, X Company received additional capital from one of its partners – Partner B – for $150,000 to expand its operations. Just like the liability account, equity accounts have a normal credit balance. How Debits and Credits Affect Equity Accounts When the company makes its annual installment of $50,000 for the next 10 years, the journal entry will then be:įor each annual payment that a company makes towards the bank loan, both the cash and bank loan accounts decrease. The bank loan increases the cash account of a company by $500,000 but at the same time, the liability also increases by the same amount.

To record the receipt of the loan, the bookkeeper of ABC Corporation will pass the following journal entry: Liabilities represent the obligations that a company owes.Īs mentioned above, liabilities represent a normal credit balance.Įach time a liability account increases, it must be credited.įor example, ABC Corporation is looking at expanding their current operations and took a bank loan from Z Bank for $500,000. How Debits and Credits Affect Liability Accounts The Cash account will have a debit balance of $80,000. To show the cash account transactions in a table, it will be: Suppose ABC Corporation purchases a piece of furniture for $20,000 in cash, the journal entry to record this will be: To decrease these accounts, Cash must be credited and Sales must be debited. Since Cash (an Asset) has a normal debit balance and Sales (an Income account) has a normal credit balance, the transaction above increased the Cash and Sales accounts.

To record this transaction under the Double Entry Bookkeeping System, the journal entry will be as follows: Income has a normal credit balance and expenses have a normal debit balance.įor example, ABC Corporation made a total cash sales of $100,000 for the month of January. In accounting, each account has a normal balance.Īssets have a normal debit balance, while liabilities and owner’s equity have normal credit balances. Under this system, when bookkeepers enter a journal entry, there should be debit and credit amounts entered and they should be equal.Ī company’s chart of accounts will represent the Balance Sheet and Income Statement accounts.įor these accounts to increase or decrease, they must be debited or credited. The question that people always ask is, when should a debit be used and when should credit be used? Debits and Credits in ActionĬompanies today use Double Entry Bookkeeping when recording transactions of a company during the accounting period. With some debits increasing other types of accounts, some will result in a decrease. Debits and credits always confuse a lot of people.

0 kommentar(er)

0 kommentar(er)